Ayanangsha Maitra, Prattyush Kala

AS THE STORMS of pragmatic geopolitics unsettle old certainties, their ripple effects—most visible in the soaring prices of essential food across African nations—are compelling the Gulf and Africa to recalibrate their equations. Gulf Cooperation Council (GCC), the phenomenally prosperous hexad, is testing new paths for diversification and influence, making Africa, a prime ground for their engagement, soft power and development as well as capacity building partner. The fastest growing markets, and logistical corridors of Africa offer new possibilities to GCC but the one major generic factor brings the two regions together: the linguistic fraternity. At least 10 nations in the mosaic continent of 54 nations speak Arabic.

In the horn region, Saudi Arabia has inked a 92-year contract to build and operate a Saudi Logistics City in Djibouti’s port area. This logistics zone is intended to serve as a major hub for Saudi exports and commerce across Africa. Djibouti port is a critical gateway for African trade, and the logistics zone will provide Saudi Arabia with enhanced access to African markets.

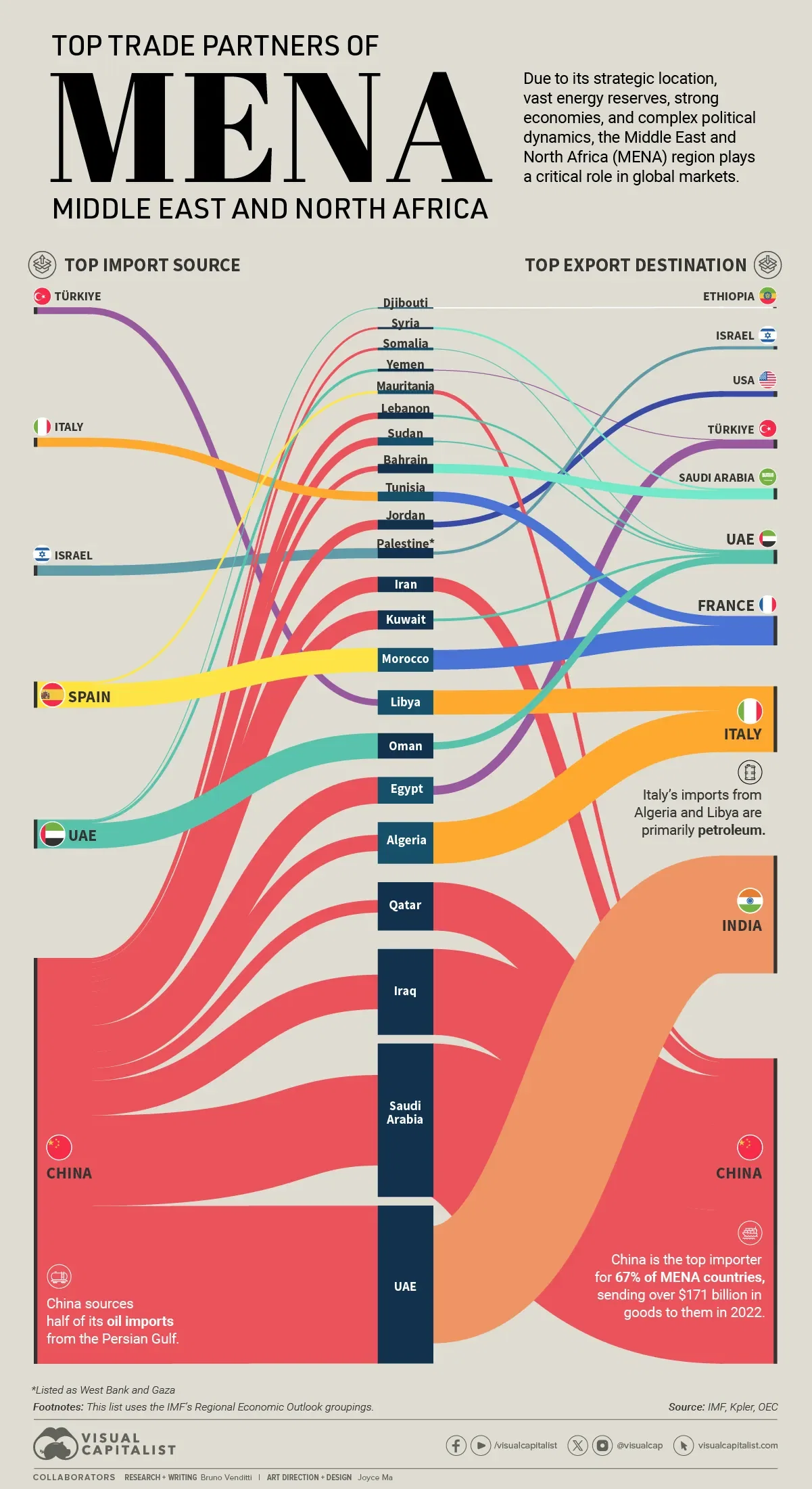

Economic partnership is the forefront of the GCC-Africa ties. Over $100 billion has been invested by GCC countries in Africa in recent years, with the UAE leading at $59.4 billion, followed by Saudi Arabia with $25.6 billion, and Qatar at $7.2 billion. These investments have primarily targeted capacity building in the continent, infrastructure, energy, agriculture, and logistics. In the shipping domain too, GCC has made a significant mark. UAE’s DP World, operates ports in over ten African nations, transforming them into regional trade hubs and creating massive local employment. Saudi Arabia’s ACWA Power has committed $7 billion to several energy projects – which are enabling access to electricity, healthcare, and education.

Saudi Arabia, the UAE, and Qatar have contracted to get access to large tracts of farmland in Ethiopia, Sudan, Kenya, and Tanzania to produce cereals, fruits, and. Saudi Star’s rice farm in Ethiopia is projected to expand to 500,000 hectares. Gulf enterprises are also investing in agro-processing units, ensuring value-added food production before export. Complementary infrastructure, including irrigation systems (e.g., Qatar in Senegal, Saudi-funded dams in Mali and Chad) and logistics (e.g., DP World’s ports), strengthens food supply chains.

Africa’s food inflation rate is a significant factor for greater level of cooperation. Horrifying increases in prices for staple items such as cereals, meat, dairy, oils, fruits, and vegetables send shockwaves to households to the political corridor. Global South actors such as Angola, Burundi, Egypt, Ethiopia, Ghana, Kenya, Tanzania, Malawi, Nigeria, Sudan, South Sudan, South Africa, Uganda, Zambia are facing severe food inflation.

At a time edible essential items are hitting hard across Africa, UAE has invested in livestock, poultry, fish processing, and date palm cultivation in Egypt, leveraging the country’s global leadership in date production. Saudi Arabia, through SALIC, has acquired significant stakes in Olam Agri Holdings, with Egypt as a key node. The $5 billion injection from the Saudi Public Investment Fund into Egypt in 2025 underscores the Gulf’s long-term commitment to agribusiness, infrastructure, and food processing. Egyptian ministries are streamlining policies to facilitate such investments, while promoting joint ventures, tech collaboration, and regional food security strategies involving Egypt, the UAE, Jordan, and Iraq.

Nevertheless, triangular partnerships between GCC, South Asia, and Africa are emerging. In these arrangements for food security and economic integration, South Asia provides agri-tech and expertise, Africa offers land and labour, and the GCC supplies capital and logistics. The partnership is growing into other sectors, including mining (e.g., lithium in Zambia), tourism, real estate, and industrial development.

Saudi Arabia and UAE have earned reputation in several African defence headquarters, by offering professional military training. The gulf nations are active in conflict mediation, as seen in Qatar’s involvement in Chad and the Congo-Rwanda peace talks. Furthermore, GCC are engaging with the African Union and AfCFTA to influence policy and trade standards across the continent.

Yet, these challenges weigh heavily on the capitals of both the GCC nations and African states. Political instability in several African states, including military-led governments, sovereignty concerns around land acquisitions and foreign military presence, and competition from other global actors like China and EU pose risks. In an era of multipolarity and coalition, areas of cooperation are emerging faster. These may range from port access for landlocked African nations, development of healthcare and education infrastructure, industrial investments in critical minerals and hydrocarbons, upskilling African youth for Gulf labour markets, easing migration and visa policies, to spheres of technological collaboration in climate-resilient agriculture.

Being the bridge nation between the two, Egypt comes into the scene with big prospects and bigger dreams. Strategically located at the intersection of Africa, the Middle East, and Europe, the resurgent economy offers Gulf investors access to COMESA and AfCFTA markets, while the Suez Canal facilitates efficient trade flows. GCC sovereign wealth funds – such as Saudi Arabia’s PIF and UAE’s ADQ – have invested billions in Egyptian companies and infrastructure, using the country as a launchpad into Africa. Egypt’s strong diplomatic ties with both the GCC and African nations further position it as a mediator and platform for development collaboration. Through the Egyptian Agency of Partnership for Development (EAPD), Gulf-backed aid and technical assistance are channelled into African development initiatives.

GCC-Africa bonhomie goes far beyond cultural affinity. It is emerging as a strategic recalibration that integrates economic ambition with geopolitical foresight, development diplomacy, and shared aspirations for stability.

Security cooperation is strengthening, but food security remains the decisive front where futures will be won or lost. Africa’s fertile lands and growing agricultural capacity, combined with GCC expertise in agri-tech, fertilizers, irrigation systems, and farmer upskilling, can forge a pathway to mutual resilience. As Africa explores its abundance of Rare Earth Minerals, the Gulf finds yet another opportunity to contribute meaningfully – helping the continent unlock prosperity while diversifying its own economic future in a sanction-disrupted global marketplace.

GCC nations like UAE, with its reputation as a hub for agricultural science and growing ambition as a global AI enabler, is well-positioned to empower Africa with AI Technology. GCC has the ability to upskill African farmers and producers into more productive, applying superior technologies. Saudi Arabia and Qatar, with their deep financial and knowledge resources, can complement this vision by powering Africa’s transitions in energy, connectivity, and mobility – essentials for building a 21st-century knowledge economy.

For GCC nations to cement a constructive role in Africa’s transformation, it must think long-term, prioritize trust-driven partnerships, and align itself with each African nations aspirations. While the two are vocal about South-South cooperation, basics such as food and energy security, and upskilling youths should be kept on top priority in an era to be governed by AI. As robust Global South actors African partners across public and corporate have to learn from the past in order to remain a committed partner of the GCC.

[ Ayanangsha Maitra and Prattyush Kala work at COGGS. Opinions expressed not necessarily reflect the view of COGGS. ]